Consumers in 2024: Uncovering Opportunities Amid Uncertainty

As reported by Euromonitor, December 2023

Approaching 2024, the consumer landscape remains dominated by a high degree of uncertainty. Although overall inflation is set to fall in 2024, core inflation – which excludes volatile food and energy prices – is expected to remain elevated. This is likely to force central banks to keep interest rates “higher for longer”, adversely impacting companies and consumers.

Per household disposable income growth is expected to decelerate to 0.5% in real terms in 2024, down from the forecasted 0.9% in 2023

Source: Euromonitor International

Prolonged high interest rates, which increase the cost of credit cards, car loans, mortgages, and other household debts, along with weak income gains will ensure consumers maintain a cautious approach in their spending habits throughout the upcoming year.

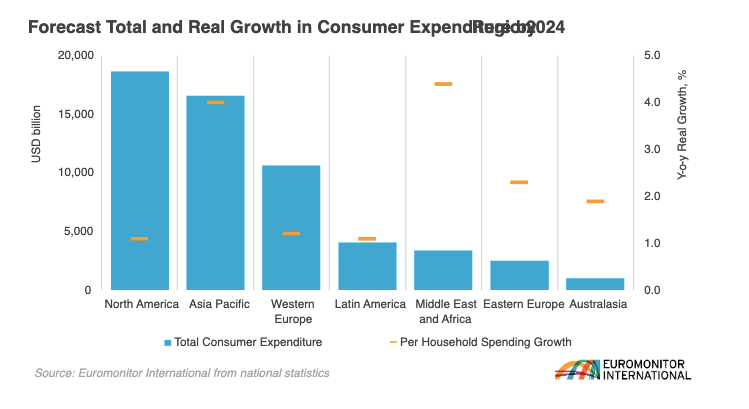

Asian consumers are drivers of global consumer expenditure

In 2024, real consumer spending in Asia Pacific is set to rise by 4.0% year-on-year, outpacing the expected 2.2% global average

Source: Euromonitor International

The importance of the region as a hub for consumer spending is underscored by the continued prominence of China, India, and Japan, which have consistently ranked among the world’s top five largest markets in terms of consumer expenditure since 2019. Meanwhile, Thailand (6.3%), Malaysia (6.1%), India and Vietnam (both at 5.6%) stand out as key countries expected to enjoy some of the world’s strongest growth in real consumer spending in 2024.

Hotels and catering, transport, and health goods and medical services are expected to be the fastest-growing categories in 2024, as Asia Pacific’s large populations, expanding tech-savvy middle classes, rising income levels and high rates of urbanisation will drive consumer spending in these categories and create significant opportunities. As businesses explore and tap into opportunities this dynamic region has to offer, they are advised to keep in mind consumers in their 50s as this demographic represents the highest-earning cohort, with their gross incomes expected to average around USD9,200 in 2024.

Worries about living costs contribute to the rise in single-person households

The global average household size will continue to shrink, with rapid growth in single-person households, ageing populations, and a decline in the average number of children per household.

Single-person households will expand faster globally than any other household type to account for 20.6% of global homes in 2024

Source: Euromonitor International

While delayed marriage and childbirth, ageing, and rising divorce rates traditionally underpin the rise of single-person households, in the current context of economic uncertainty, worries about living costs, personal finance, health and wellness are additional factors contributing to hesitancy among many people to commit to stable relationships, cohabitation, and parenting. Businesses across industries and categories must adapt their offerings to cater for smaller and single-person households, especially in advanced economies where the proportion of single-person households is considerably higher than the global average.

Consumers will continue to seek affordability and value

Consumers will continue to be cautious and selective in their spending in an effort to reduce unnecessary expenditure, save money, and keep up with the cost of living. In their search for affordability and value, however, consumers do not evaluate purchases simply in terms of value for money, but also in terms of overall quality of life, health and wellbeing, new experiences, and joy. According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey (fielded in January-February 2023, n=40,691), nearly two thirds (65.3%) of consumers buy small indulgences for themselves as they bring them joy and make them feel good.

Consumers will continue to adopt consumption behaviours that allow them to minimise costs and maximise value, all the while maintaining their standards of living. These include buying higher quality to enhance durability, repairing broken items instead of replacing them, and even renting instead of owning.

Additionally, consumers are turning into Value Hackers—a top trend in 2024—as they look for novel ways to stretch their wallets. For example, they opt for “dupes” (or reproductions), pay with credit card rewards/points, and switch to premium private label options. “Deinfluencers” have also become popular on social media where people expose products they believe are overhyped or overpriced.

As businesses gear up for the challenges and opportunities of 2024, the key to success is linked to a nuanced understanding of changing consumer priorities and preferences. Navigating this consumer reality requires a commitment to delivering affordability and value by putting consumers at the heart of the business, connecting with them on a deeper level and helping them make affordable decisions that add value to their lives.

You can contact Metta if you need market research, consumer research, customer journey building, … to identify the actual and hidden needs of customers to bring the highest value to customers, thereby building an effective business strategy.

Translated by Metta Marketing

According to Euromonitor, 12/2023

Metta Marketing

Born to build Brands